Warren Buffett’s Berkshire Hathaway disclosed a $1.6 billion stake in UnitedHealth, surprising markets amid the insurer’s steep 2025 losses and ongoing federal investigations.

Warren Buffett’s Berkshire Hathaway Reveals $1.6B Stake in Troubled UnitedHealth

Warren Buffett’s investment giant Berkshire Hathaway has taken a bold position in UnitedHealth Group, acquiring more than 5 million shares worth approximately $1.6 billion during the second quarter of 2025. The move comes despite the insurer’s sharp stock decline this year and ongoing regulatory scrutiny — a classic Buffett-style bargain play.

The purchase was disclosed in Berkshire’s latest SEC Form 13F filing, which details the company’s equity holdings as of June 30.

Buffett’s Bold Buy Amid UnitedHealth’s Challenges

The decision to invest in UnitedHealth comes at a time when the company is navigating one of the toughest stretches in its corporate history. Shares have fallen nearly 50% year-to-date due to:

- A Justice Department investigation into Medicare billing practices

- The abrupt resignation of CEO Andrew Witty in May

- Withdrawal of its annual earnings guidance earlier this year

- A revised 2025 outlook that missed Wall Street expectations

While many investors have fled, Buffett — or possibly his investment deputies Todd Combs and Ted Weschler — saw an opportunity to acquire shares at a significant discount.

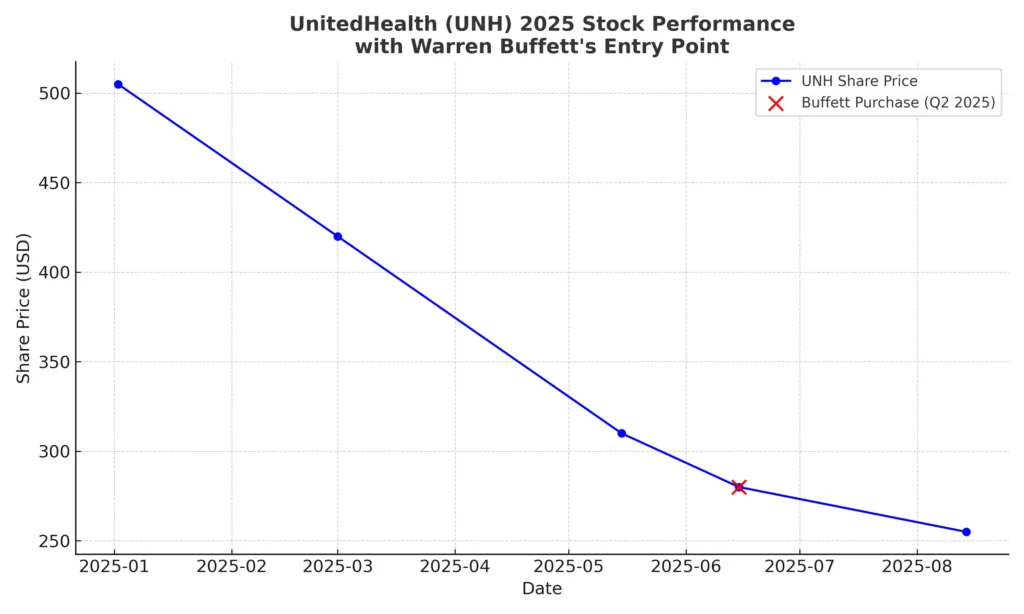

UnitedHealth Stock Performance in 2025

Despite Thursday’s rally following the Berkshire news, UnitedHealth’s overall performance in 2025 has been weak compared to its historical growth trajectory.

| Date | UNH Share Price | % Change YTD |

|---|---|---|

| Jan 2, 2025 (Open) | $505 | — |

| May 15, 2025 | $310 | -38.6% |

| Aug 14, 2025 (Close) | $255 | -49.5% |

| Aug 14, 2025 (After-Hours) | $270 | -46.5% |

Following Berkshire’s disclosure, the stock jumped more than 6% in after-hours trading, signaling renewed investor optimism.

Berkshire Hathaway’s Portfolio Context

Berkshire Hathaway’s equity portfolio is valued at roughly $300 billion. UnitedHealth now ranks as its 18th largest holding, just behind Amazon and Constellation Brands.

Other notable moves in the latest quarterly filing include:

| Stock | Action | Value of Stake |

|---|---|---|

| UnitedHealth | New stake | $1.6 billion |

| D.R. Horton | Increased | Not disclosed |

| Lennar | Increased | Not disclosed |

| Nucor | Increased | Not disclosed |

| Apple | Trimmed | Largest position still |

| Bank of America | Trimmed | $28 billion stake |

This pattern suggests Berkshire is diversifying while still holding onto its cornerstone investments.

Who Made the Call: Buffett or His Deputies?

Although Buffett is closely associated with every major Berkshire move, it’s possible that Todd Combs or Ted Weschler initiated the UnitedHealth purchase. Buffett has previously credited them with other high-profile picks, including Amazon in 2019.

Buffett typically favors companies with:

- Strong cash flows

- Defensible market positions

- Attractive valuations during downturns

UnitedHealth, as the largest private health insurer in the U.S., fits this profile despite current challenges.

UnitedHealth’s Regulatory Troubles

The insurer is currently under investigation by the U.S. Department of Justice over allegations of inflated Medicare Advantage billing. The case has amplified public criticism over rising health care costs.

In May, UnitedHealth withdrew its 2025 earnings forecast, citing uncertainty from the investigation and operational issues. Shortly afterward, CEO Andrew Witty resigned, and the board appointed an interim leader.

Last month, the company issued a revised 2025 earnings outlook that came in well below Wall Street expectations, deepening investor concerns.

Why Buffett Might See Opportunity

Buffett has long believed in buying quality companies during times of distress, arguing that “be fearful when others are greedy, and greedy when others are fearful.”

Here’s why UnitedHealth might have appealed to him (or his team):

- Strong market position – Largest private health insurer in the U.S.

- Long-term demand – Health insurance is a necessity, not a luxury

- Potential rebound – Oversold stock after nearly 50% decline

- Cash generation – Historically strong operating cash flows

Historical Stock Trend for UnitedHealth

To understand the depth of the current slump, here’s a look at UnitedHealth’s 5-year stock performance:

| Year-End | Share Price | Annual % Change |

|---|---|---|

| 2020 | $352 | +12.4% |

| 2021 | $420 | +19.3% |

| 2022 | $505 | +20.2% |

| 2023 | $492 | -2.6% |

| 2024 | $505 | +2.6% |

| 2025 (YTD) | $255 | -49.5% |

Market Reaction and Analyst Opinions

The 6% after-hours jump on Aug. 14 indicates that Buffett’s seal of approval has at least temporarily boosted sentiment. Analysts, however, remain divided:

- Optimists argue that the stock is undervalued and positioned for a rebound once legal issues resolve.

- Skeptics warn that the DOJ investigation and earnings uncertainty could drag on, limiting near-term gains.

What This Means for the Health Care Sector

Berkshire’s investment could also spark broader interest in the health insurance sector, which has been under pressure due to regulatory risks. If UnitedHealth stabilizes, rivals such as Humana and Cigna could also benefit from renewed investor confidence.

Key Takeaways

- Berkshire Hathaway bought 5M+ shares of UnitedHealth worth $1.6B in Q2 2025.

- The stock is down nearly 50% YTD due to regulatory and leadership challenges.

- The buy reflects Buffett’s contrarian investing style — seeking value during downturns.

- UnitedHealth now ranks as Berkshire’s 18th largest position.

FAQs

1. Why is UnitedHealth stock down so much in 2025?

Because of a DOJ investigation, loss of CEO leadership, and a weaker-than-expected 2025 earnings outlook.

2. Did Warren Buffett personally buy UnitedHealth shares?

It’s unclear — the purchase may have been made by his investment deputies Todd Combs or Ted Weschler.

3. How many shares did Berkshire buy?

Over 5 million shares, valued at about $1.6 billion.

4. What was the market reaction?

UnitedHealth shares rose about 6% in after-hours trading after the filing.

5. What other stocks did Berkshire change positions in?

They added D.R. Horton, Lennar, and Nucor, while trimming Apple and Bank of America.