Nvidia 5 Trillion Valuation as its AI growth, U.S. manufacturing, and strategic partnerships drive record stock highs. Explore the key factors behind Nvidia’s market dominance and future outlook.

Nvidia 5 Trillion Valuation: The Rise of a Tech Giant

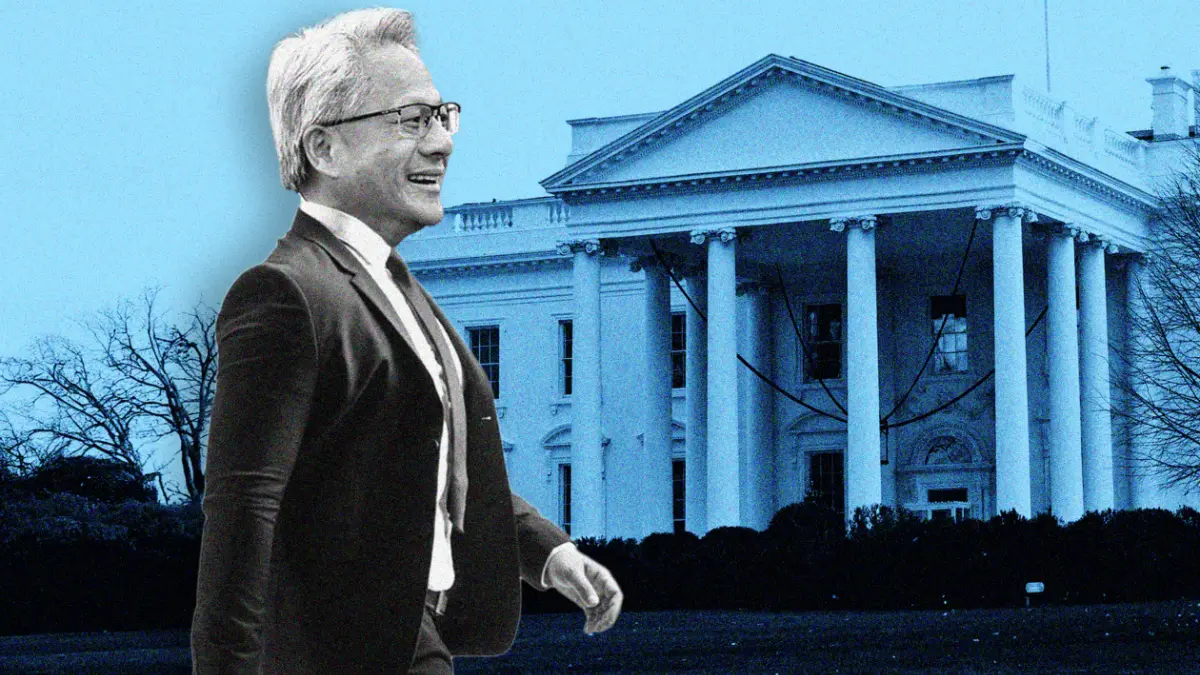

Nvidia is on the verge of a historic milestone, closing in on a Nvidia 5 Trillion Valuation. The company’s meteoric rise has been fueled by advances in artificial intelligence, strategic partnerships, and strong alignment with U.S. technology policies. CEO Jensen Huang’s leadership and Nvidia’s aggressive expansion into AI and networking have positioned it as a global tech powerhouse.

As Nvidia’s stock soars, investors and analysts are closely watching its trajectory, which reflects the growing importance of AI infrastructure, semiconductor innovation, and U.S. manufacturing.

Nvidia Stock Hits Record Highs

Nvidia 5 Trillion Valuation recently closed at an all-time high of $201.03 per share, representing a 4.98% increase in a single session. To reach the coveted $5 trillion market cap, the stock needs to close at $205.76, a feat analysts believe is achievable given Nvidia’s strong momentum.

| Metric | Value |

|---|---|

| Current Stock Price | $201.03 |

| Market Capitalization | $4.885 trillion |

| Required Price for $5T Valuation | $205.76 |

| 4-Day Stock Gain | +11.51% |

| Record-High Market Cap | Achieved Tuesday, Oct. 28, 2025 |

The surge reflects not only investor confidence in Nvidia’s AI growth but also its innovative semiconductor platforms, such as Blackwell and Vera Rubin.

Blackwell and Vera Rubin: Driving AI Growth

Nvidia’s Blackwell AI platform is now in full production in Arizona, highlighting the company’s commitment to U.S.-based manufacturing. Partnering with Taiwan Semiconductor Manufacturing Co. (TSMC), Nvidia produced the first Blackwell wafer in the U.S., marking a significant milestone in domestic chip production.

The Vera Rubin platform complements Blackwell, enabling high-performance AI computations for global enterprises. According to Jensen Huang, Nvidia has visibility into over $500 billion in cumulative revenue from these platforms in the next five quarters, excluding China.

| Platform | Purpose | Projected Revenue |

|---|---|---|

| Blackwell AI | AI chip production and AI infrastructure | $500B+ (next 5 quarters) |

| Vera Rubin | Next-gen GPU computing | Included in Blackwell projections |

Nvidia’s Networking Ambitions and 6G Innovation

Nvidia is expanding its reach into AI-driven networking. The company took a $1 billion stake in Nokia, positioning the telecom giant as a partner in AI-RAN products that will support 5G-Advanced and 6G networks.

“The partnership highlights the convergence between telecom infrastructure and AI-driven networking,” said Evercore ISI analyst Amit Daryanani. Nvidia’s Aerial RAN Computer Pro platform enables telecom providers to leverage AI for faster, more efficient networks, emphasizing the company’s growing dominance in AI and networking technology.

Nvidia and U.S. Manufacturing: Strategic Moves

President Donald Trump has emphasized the importance of domestic manufacturing for national security and job creation. Nvidia’s expansion of chip production in Arizona aligns with this vision. Jensen Huang stated, “Bring manufacturing back because it’s necessary for national security. Bring manufacturing back because we want the jobs.”

Nvidia’s commitment to U.S.-based production strengthens its AI infrastructure leadership and positions the company favorably with policymakers, ensuring continued support for domestic innovation.

Navigating U.S.-China AI Competition

Nvidia’s China business faces challenges from both the U.S. and Chinese governments. Export restrictions temporarily halted sales of Nvidia’s H20 chips to China, resulting in a $4.5 billion charge. However, Nvidia negotiated export licenses with the U.S., enabling sales under a revenue-sharing arrangement.

Jensen Huang emphasized that U.S. semiconductor leadership remains critical, while also acknowledging China’s energy advantage in AI development. Nvidia is actively advocating for the approval of its Blackwell-based B30 chips for the Chinese market, ensuring continued global expansion despite geopolitical risks. Nvidia 5 Trillion Valuation

Quantum Computing and NVQLink

Nvidia 5 Trillion Valuation is innovating beyond traditional AI. Its NVQLink interconnect technology connects quantum processing units (QPU) to GPUs for quantum computing control and error correction. The system scales from hundreds to hundreds of thousands of qubits, enabling quantum GPU applications alongside AI supercomputers.

This positions Nvidia 5 Trillion Valuation at the forefront of next-generation computing, solidifying its role as a technological leader. Partnerships with 17 QPU companies underscore Nvidia’s influence in the emerging quantum AI ecosystem.

Government Relations and Strategic Alignment

Jensen Huang has become a prominent figure in Washington, D.C., advocating for AI infrastructure and U.S. manufacturing. Nvidia’s collaboration with the Trump administration ensures continued support for domestic production and access to global markets.

| Government Focus | Nvidia Initiative |

|---|---|

| National Security | U.S. chip manufacturing |

| AI Leadership | Blackwell & Vera Rubin platforms |

| Trade Relations | Export licenses to China |

| Networking Innovation | AI-RAN partnerships |

Conclusion: Nvidia 5 Trillion Valuation

Nvidia’s trajectory toward a Nvidia 5 Trillion Valuation is driven by a combination of AI leadership, strategic partnerships, U.S. manufacturing, and innovative technologies like quantum computing and next-gen GPUs. Jensen Huang’s proactive engagement with policymakers and global partners ensures Nvidia remains at the forefront of technological and financial growth.

The company’s bold vision, strong AI growth, and diversified innovation make reaching this historic milestone a realistic possibility in the near future.

FAQs Nvidia 5 Trillion Valuation

Q1: What is Nvidia’s current market capitalization?

A1: As of October 28, 2025, Nvidia’s market capitalization is $4.885 trillion, closing at a record-high stock price of $201.03 per share.

Q2: How close is Nvidia to reaching a $5 trillion valuation?

A2: Nvidia needs its stock to reach $205.76 per share to hit the $5 trillion milestone.

Q3: What are Nvidia’s key AI platforms?

A3: Nvidia’s key AI platforms are Blackwell AI and Vera Rubin, which drive high-performance computing and AI infrastructure.

Q4: How is Nvidia contributing to 6G and telecom innovation?

A4: Nvidia partnered with Nokia for AI-RAN products and launched the Aerial RAN Computer Pro platform, enabling telecom providers to transition to AI-driven 6G networks.

Q5: How does Nvidia navigate U.S.-China trade tensions?

A5: Nvidia negotiated export licenses for its H20 chips under a revenue-sharing arrangement with the U.S., while developing B30 Blackwell chips for China.